Personal Checking

Personal Checking

Open a checking account that fits your life, not the other way around.

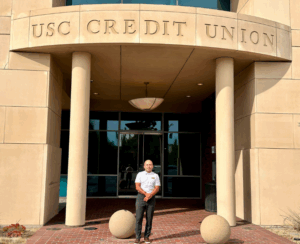

There’s more than one way to enjoy the many benefits of being a USC Credit Union member-owner: Pick the one that’s right for you. Whether you’re looking for a basic no-frills, no-fee option or a high-yield, interest-bearing checking account, we’ve got you covered.* As your not-for-profit credit union, we’re here to enhance your financial well-being, starting with a checking account that fits your life, never the other way around.

Benefits:

- Bank on the go and pay bills with Mobile and Online Banking

- $0 liability for unauthorized payments with debit card

- Get paid early with the convenience of Direct Deposit

- Easy transfer of funds and free account alerts

- Access to 30,000 fee-free ATMs and 5,000 shared branches

- Low deposit requirements and low or no fees

Take your banking to the next level with a PremiumSpend high-value checking account that rewards you for your relationship with us. From competitive dividends to premium perks, this is more than just a checking account, it’s a smart financial move.

- Early paycheck with direct deposit

- Earn a competitive dividend on your checking balance.

- Earn more with Smart Yield Savings.

- Enjoy additional premium benefits at no extra charge and high-value features designed to support your financial goals

- Save more with additional discounts

- Check your credit score for free

Get the most from your everyday banking with a FlexSpend checking account. It’s a flexible, full-featured account designed to fit all your primary banking needs. With easy ways to waive the monthly fee, it’s built to reward your everyday banking activity.

- Early paycheck with direct deposit

- Waive the monthly fee with ease

- Perfect for everyday use – tailored to support your full financial life

- Flexible and affordable – no-frills banking with real value

- Check your credit score for free

- Optional overdraft protection

One less thing to stress about. The CampusSpend checking account is designed just for busy students like you. Giving you the tools to manage your money with confidence and ease.

- No monthly fee1 – more savings for what matters most

- 2 free non-shared network ATM transactions a month2

- 2 free incoming wire transfers3 – domestic or international

With CampusSpend checking, you can focus on school, not your bank account.

Banking should be simple, and with a SimpleSpend checking account, it is. Built for everyday use, this account offers a secure, stress-free way to manage your money.

- Early paycheck with direct deposit

- Your simple, no fee, daily option – perfect for managing daily finances

- Check your credit score for free

- Bank On Certified – a national initiative that meets standards for transparency, low cost, and accessibility

Just like cash.

Use at gas stations, grocery stores, shops and restaurants worldwide. It’s filled with perks, including EMV chip technology for added security.

- Withdraw up to $500 cash per day

- FlexSpend Account holders receive five (5) free non-USC Credit Union ATM transactions per month.

- PremiumSpend Account holders receive unlimited free non-USC Credit Union ATM transactions each month.

Which checking account is right for you?

PremiumSpend |  FlexSpend |  CampusSpend |  SimpleSpend | |

|---|---|---|---|---|

| The right fit if you want a… | Our highest interest checking account that rewards you for your relationship with us. | A smart, flexible checking account that fits your life, with everyday rewards and easy ways to waive the monthly fee. | A free account for students built for financial independence. | Built for everyday use, this account offers a secure, stress-free way to manage your money. |

| Minimum Opening Balance | $25 | $25 | $0 | $10 |

| Daily Balance Requirement | $5,000 minimum daily balance in checking OR $25,000 in combined share balances | Minimum $500 Monthly Direct Deposit OR $1,500 average balance in checking OR $5,000 in combined share balance OR 10 Debit Card Transactions | None | None |

| Monthly Service Charges | $8.95 | $4.95 | None | None |

| Dividends | Dividends are earned daily, credited, and compounded monthly at the rate that corresponds to the account balance. Earn more with Smart Yield Savings | N/A | N/A | N/A |

| Free Online Banking | Yes | Yes | Yes | Yes |

| Free Withdrawals at USC Credit Union, Co-Op, Shared Network or Citibank (branch only) ATMs* | Yes Plus, unlimited free transactions at non-USC Credit Union and Co-Op ATMs** | Yes Plus, five free transactions at non-USC Credit Union and Co-Op ATMs per month** | Yes Plus, two free transactions at non-USC Credit Union and Co-Op ATMs per month** | Yes |

| Additional Features | 3 FREE cashier’s checks or money orders/month**** Free incoming domestic wire transfers Early direct deposit Free check writing and temporary checks Complimentary financial review with Trojan Wealth Management 1 free credit union notary service/month Additional 0.25% APY on USC Credit Union certificate dividends $250 discount on closing costs on approved USC Credit Union home loans | Extended coverage for everyday debit card transactions (optional) Early direct deposit Access to check writing | Early direct deposit 2 FREE incoming wire transfers/year*** | Early direct deposit No access to check writing Not eligible for overdraft transfers Bank On Certified |

| Free Debit Card | Yes | Yes | Yes | Yes |

| Zelle/Virtual Wallet | Yes | Yes | Yes | Yes |

| Open PremiumSpend | Open FlexSpend | Open CampusSpend | Open SimpleSpend |