All PremiumSpend Benefits

All PremiumSpend Benefits

Access premium benefits at no extra charge – designed to support your financial goals, health, everyday discounts, and protection for life’s surprises.

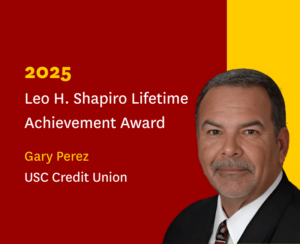

- Bundle PremiumSpend with Smart Yield Savings to earn up to 3.55% APY2

- Earn more with a 0.25% dividend rate bonus on USC Credit Union certificates.

- Unlock savings with a 0.25% rate discount on USC Credit Union Vehicle, GoGreen, Personal, and Student Loan Refinance loans

- Save more with a $250 discount on closing costs on approved USC Credit Union home loans

- Early paycheck with direct deposit

- Earn a competitive dividend on your checking balance

- Complimentary financial review with a Trojan Wealth Management advisor

- Free unlimited domestic ATM transactions at non-network ATMs when using your USC Credit Union account; other institutions’ ATM fees may still apply.

- 3 free cashier’s check or money orders per month

- 1 free credit union notary service per month

- Free check writing as well as temporary checks

- Free incoming domestic wire transfers

- Optional free paper statements

IDProtect® identity theft monitoring and resolution services3 for you, and your joint account owner(s):

Up to $10,000 Identity Theft Expense Reimbursement Coverage5

Receive up to $10,000 to help pay expenses, clear your name and restore your identity, should you become the victim of identity fraud.

Fully Managed Identity Theft Resolution Services

Access to a dedicated fraud specialist assigned to manage your case until your identity is restored.

Identity Monitoring

Monitoring of over 1,000 databases. (registration/activation required)

Credit File Monitoring

Daily credit file monitoring and automated alerts of key changes to your credit report. (registration/activation required)

Credit Report

Ability to request a single bureau credit report every six months or upon opening a resolution case. (registration/activation required)

Credit Score4

Ability to request a single bureau score every month. (registration/activation required)

Credit Score Tracker

Receive valuable insight into your credit score4,6. (registration/activation required)

CyberRecoverTM

Get 24/7 access to personal cyber advocates who can help defend against extortion, ransomware, online fraud, gaming security risks and more. These experts provide immediate support and guidance helping you navigate and mitigate the impact of cyber incidents. With CyberRecover, feel secure knowing that professional help is always available to protect your online life.

These features are available through your Club Checking account.

Travel and Leisure Discounts

Money-saving discounts from thousands of local and national businesses – redeem and print coupons online or access discounts from a mobile device. Digital access makes saving super easy and convenient, giving instant savings anywhere, anytime. (available via mobile or web only)

Roadside Assistance Service5

24-hour coverage for roadside assistance services including vehicle towing, fuel/oil/fluid/water delivery, and battery/lock-out/tire assistance up to $100 per occurrence. Maximum of two occurrences per twelve month period.

Cell Phone Protection5

Receive up to $400 of replacement or repair costs if your cell phone is stolen or damaged, in the U.S. and abroad. $50 deductible applies3. Up to two claims per eligible account, per twelve-month period. Covers up to four phones on a cell phone bill. Cell phone bill must be paid using PremiumSpend Checking account.

These features are available through your Club Checking account.

Health Discount Savings

Enjoy savings on vision, prescriptions and dental services. This is NOT insurance. (registration/activation required)

Telehealth7

Access to 24/7 video or phone visits with U.S.-based board-certified, licensed and credentialed doctors ready to help with physical and mental health care. There are zero copays, plus discounts on prescriptions and lab work. (registration/activation required)

These features are available through your Club Checking account.