USC Student

USC Student

Banking built for USC students.

Discover student-focused banking built for USC students! Experience the benefits of fee-free checking accounts, feature-rich savings accounts, affordable student loans, low-rate credit cards and a wealth of financial tools to help you build and safeguard your financial well-being. Enjoy the convenience of having all your banking needs in one place.

Home

One less thing to stress about. The CampusSpend checking account is designed just for busy students like you. Giving you the tools to manage your money with confidence and ease.

- No monthly fee** – more savings for what matters most

- 2 free incoming wire transfers1 – domestic or international

- 2 free non-shared network ATM transactions a month2

With CampusSpend checking, you can focus on school, not your bank account.

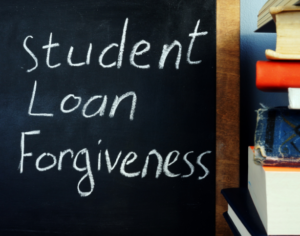

Fill funding gaps between tuition and other educational expenses, refinance private student loans, or pursue a professional certificate – whatever your goal, ours is to ensure you focus on your education, not the cost.

- Financing for undergraduate or graduate students

- Complete one simple online application

Pursuing a professional certificate can be expensive. Our Certificate Program Loan is designed to help educators enrolled in one of USC’s Rossier School of Education Professional Development programs.

- Specialized loan program

- Loan amounts up to $10,000

APY is accurate as of 2.26.2026

Rates as low as:

5.90% Fixed

The Computer Loan Program offers a discounted rate3 and flexible repayment of up to 36 months on your next computer purchase from the USC Bookstore! Available to USC students, faculty, staff, alumni and Trojan parents.

Here’s How It Works

- Receive a Computer Quote from the USC Bookstore.

- Apply for a USC Credit Union personal loan at a branch, by phone, or online. Use the promo code: USCTECH

- Upon approval, schedule pickup with the USC Bookstore!

Computer must be for personal use. Computer Loans are funded directly to the USC Bookstore.

APY is accurate as of 2.26.2026

Fixed as low as:

4.49%

Your degree is the goal. We’ll help you support the journey, and what comes next.

Being a USC student means balancing a lot: classes, work, rent and planning for the future. That’s why we offer student-friendly banking, financial wellness resources and practical guidance to help you budget smarter, build credit and stay on track during your time at USC. We’ll continue to support your financial goals long after graduation, wherever your Trojan journey leads.

Flower Street

BranchUniversity Park Campus

3720 S Flower Street,

CUB 1st Floor,

Los Angeles, CA 90007

Get Directions to Flower Street

Branch University Park Campus

Make Appointment for Flower Street

Branch University Park Campus

Branch University Park Campus

Health Sciences Campus BranchHealth Sciences Campus

1969 Zonal Avenue,

SRH 101B,

Los Angeles, CA 90033

Get Directions to Health Sciences Campus Branch Health Sciences Campus

Make Appointment for Health Sciences Campus Branch Health Sciences Campus

University Village

BranchUniversity Park Campus

3096 South McClintock Ave,

Suite 1430,

Los Angeles, CA 90089

Get Directions to University Village

Branch University Park Campus

Make Appointment for University Village

Branch University Park Campus

Branch University Park Campus

Campus Center

BranchUniversity Park Campus

3601 Trousdale Pkwy,

STU 106,

Los Angeles, CA 90089

Get Directions to Campus Center

Branch University Park Campus

Make Appointment for Campus Center

Branch University Park Campus

Branch University Park Campus

Student Resources

Made for USC Students

Have questions or need support? Connect with a member representative for clear, friendly guidance, whether you’re opening your first account, managing money as a Trojan or planning what comes after graduation.

USC Credit Union is easy, simple and convenient to use. I know a lot of international and domestic students who use it, so you know it’s good. Fight on, USC Credit Union!

When using Zelle®, only send money to those you trust. If the recipient is already enrolled with Zelle®, you can’t cancel a payment once it’s been sent. Neither USC Credit Union nor Zelle® offers a protection program for authorized payments made with Zelle® – for example, if you do not receive the item you paid for, or the item is not as described or as you expected. If you are asked to send yourself money with Zelle® or are asked to provide your Zelle® credentials, don’t click on text message links or call the number that contacted you. Do not share your Zelle® and any other passwords with anyone.

Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

**Must qualify for USCCU membership and membership fee may apply; please call (877-670-5860) or visit www.USCCreditUnion.org to confirm eligibility. Must be a USC Student and at least 17 years old. Converts to FlexSpend 6 years after account opening. Must pass Chexsystem. All accounts are subject to approval process. If new membership is closed within the first 90 days, there is a $5 early membership fee. Limit one (1) Student Checking Account per Student ID Number. CampusSpend is not applicable to organizational or business entities and must be opened as a personal accounts. Accounts are subject to all terms and conditions set forth in the Account Agreement and Truth-In-Savings Disclosure and CampusSpend Disclosure.

12 free incoming wires annually by calendar year, starting January 1st and ending December 31st, (combined domestic and foreign) with CampusSpend. See Schedule of Fees for subsequent transactions.

2Citibank free ATM transactions or inquiries apply only to ATMs at Citibank branch locations. Two free non-shared network ATM transactions per month with CampusSpend, five free with Gold Checking, unlimited with Trojan Checking. When you use an ATM not displaying the USCCU or Co-Op ATM symbols, the ATM owner may charge additional fees. View our Schedule of Fees for details on any fees you may incur.

3“As low as” rates include applicable discounts and reflect the Annual Percentage Rate (APR) effective as of [pmrateseffectivedate tableid=9740]. Available rate discounts may include a 0.25% discount for automatic loan payments and a 0.25% discount for maintaining an active PremiumSpend checking account, for members who qualify. To qualify for the automatic payment rate discount, loan payments must be made automatically from a USC Credit Union checking account. The APR is based on creditworthiness and underwriting factors. Monthly payment per $1,000 for 12 months at [pmrates tableId=9740 cellId=8766 rowId=5435] is [pmrates tableId=4601 cellId=8766 rowId=9329018]. Must be a current USC student or faculty or staff, USC alumni, admitted USC student, or parent of current or admitted USC student. Proof of income may be required at the time of loan funding. Membership eligibility requirements and membership fees may apply; please call (213-821-7100) or visit www.USCCreditUnion.org to confirm eligibility. All credit union loan programs, rates, terms, and conditions are subject to change without notice.