MoneySense

When you pay your bills online, guess what makes those transactions efficient and secure? That’s right, the ACH network. In 2021 alone, this remarkable technological system processed 29.1 billion payments of more than $72.6 trillion.

Enjoy powerful protections and everyday perks with PremiumSpend checking, including identity protection, cell phone coverage, roadside assistance, savings, and more, all at no additional cost.

Earn up to 3.55% APY*. No Fees. Low Minimum. Extended Insurance Coverage.

Discover special offers, tools and financial solutions curated just for Trojans, quickly and easily in the Trojan Hub.

Already a member? Extend the benefits of USC Credit Union membership to everyone in your immediate family or household – they’re all invited to become a member owner!

Get a free financial education on all things personal finance from credit scores and debt consolidation to saving and student loans.

Enjoy powerful protections and everyday perks with PremiumSpend checking, including identity protection, cell phone coverage, roadside assistance, savings, and more, all at no additional cost.

Earn up to 3.55% APY*. No Fees. Low Minimum. Extended Insurance Coverage.

Discover special offers, tools and financial solutions curated just for Trojans, quickly and easily in the Trojan Hub.

Already a member? Extend the benefits of USC Credit Union membership to everyone in your immediate family or household – they’re all invited to become a member owner!

Get a free financial education on all things personal finance from credit scores and debt consolidation to saving and student loans.

Get a free financial education on all things personal finance from credit scores and debt consolidation to saving and student loans.

Create a one-time, recurring, or future-dated transfer from your savings or checking account without the need for checks, wire transfers or credit cards.

Use internal transfers to move money between your USC Credit Union accounts, or between your USC Credit Union account and another USC Credit Union member’s account.

Use external transfers to move money between your USC Credit Union account to your accounts at other financial institutions.

To start, simply:

Sending money to another USC Credit Union member or to your external account? Add the account under the Transfers widget before setting up the transfer.

To send money securely to other individual’s external accounts, learn more about Wire Services.

When you pay your bills online, guess what makes those transactions efficient and secure? That’s right, the ACH network. In 2021 alone, this remarkable technological system processed 29.1 billion payments of more than $72.6 trillion.

Internal accounts are within USC Credit Union. This includes your USC Credit Union accounts and another member’s USC Credit Union account. Internal transfers are instant, and the funds will be available immediately.

Like most financial institutions, we use the Automated Clearing House (ACH) network to process external transfers from one financial institution to another.

The funds from an external transfer made between your USC Credit Union and your non-USC Credit Union account before 5:00pm PST, Monday-Friday will be available on the 4th business day. Keep in mind, weekends or holiday will affect transfer times.

Use USC Credit Union’s Transfers service on Online or Mobile Banking to make internal and external transfers.

Easy to use and transfer deposits are quick!

-Lorraine

Free ATMs. Free Online Banking. USC Credit Union checking accounts give you perks and plenty of choices from our no-fee basic to interest-bearing accounts.

Go cashless! Your Debit/ATM card lets you access the funds in your checking account with one quick swipe.

Get paid early! Have your paycheck or any recurring payments deposited electronically into your checking account online. It’s safe, easy to set up, and a real timesaver.

In 2026, Lunar New Year begins on February 17 and ushers in the Year of the Horse – specifically the Fire Horse – a symbol of courage, action, independence, and forward momentum. It’s the perfect moment to take charge of your financial future, from short-term goals to long-term retirement planning.

Lunar New Year: Ride Into Prosperity

Los Angeles, CA — Following its October 20, 2025, victory in the Rivalry for a Cause Charity Challenge, USC Credit Union is recognizing the impact of the initiative after defeating Notre Dame Federal Credit Union 2,884–1,464. The friendly competition transformed a historic college football rivalry into meaningful community impact.

USC Credit Union Wins Rivalry for a Cause Charity Challenge, Secures $10,000 for Community Foundation

Recent developments signal the elimination of the SAVE income-driven repayment plan—so it’s important to understand what this means for your budget and what options remain available.

The End of the SAVE Plan: What It Means for Student Loan Borrowers

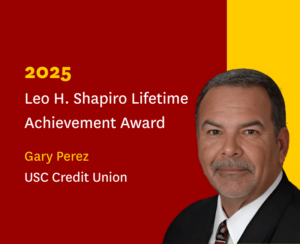

Palm Desert, CA. November 3, 2025 — California and Nevada’s credit union community gathered October 26 – October 30 at the REACH 2025 conference to celebrate innovation, leadership, and service across the industry. The annual Credit Union Awards dinner brought together credit union professionals, advocates, and partners for an evening dedicated to recognizing the individuals and organizations that embody the cooperative spirit of “people helping people.”

USC Credit Union CEO/President Gary J. Perez Receives Prestigious Leo H. Shapiro Lifetime Achievement Award on behalf of the California and Nevada Credit Union Leagues

With the holidays approaching, scammers ramp up activity. We want to help you spot the most common frauds we’re seeing and share simple steps to protect yourself and your accounts. Learn more about the current trends and concrete examples, plus what to do if something looks suspicious.

Fraud Alerts & Tips to Stay Safe This Holiday Season

For José Orozco Pelico, the message is simple but urgent: the Latino community is losing out financially by not embracing the opportunities offered by clean energy. Beyond money, many families simply don’t have the information they need to take the first steps toward a future where clean energy will soon be the norm.

José Orozco Pelico: Latino Communities Are Missing Out on Clean Energy Savings

The USC Credit Union Community Foundation, in partnership with LA County DEO and AJCC, distributed $80,000 from the Southern California Wildfire Relief Fund to provide $1,000 in direct cash aid to 80 families impacted by the Eaton and Pacific Palisades fires, underscoring the power of collaboration in delivering meaningful relief.

Credit Unions and LA County DEO Continue Wildfire Relief with $80K in Direct Assistance

USC Credit Union is proud to announce its ongoing commitment to expanding clean energy access for low-income and disadvantaged communities across Los Angeles and Orange Counties through innovative lending programs and partnerships.

Not Just Green: USC Credit Union Advocates for Clean Energy as Essential Infrastructure for Community Health

We’re honored to celebrate our President and CEO, Gary Perez, for receiving the Leo H. Shapiro Lifetime Achievement Award – the highest recognition from California’s Credit Unions and Nevada’s Credit Unions.

USC Credit Union President and CEO Gary Perez: Leo H. Shapiro Lifetime Achievement Award

Read the original press release at: https://www.ccul.org/news/juntos-avanzamos-designation-bolsters-inclusion-at-usc-cu/

On Monday, USC Credit Union proudly hosted a proclamation ceremony that officially marked its designation as a Juntos Avanzamos (“Together We Advance”) credit union. This national recognition, led by Inclusiv, highlights the credit union’s commitment to fostering financial inclusion, accessibility, and cultural services specifically for Latino and immigrant communities.

Juntos Avanzamos’ Designation Bolsters Inclusion at USC Credit Union